About

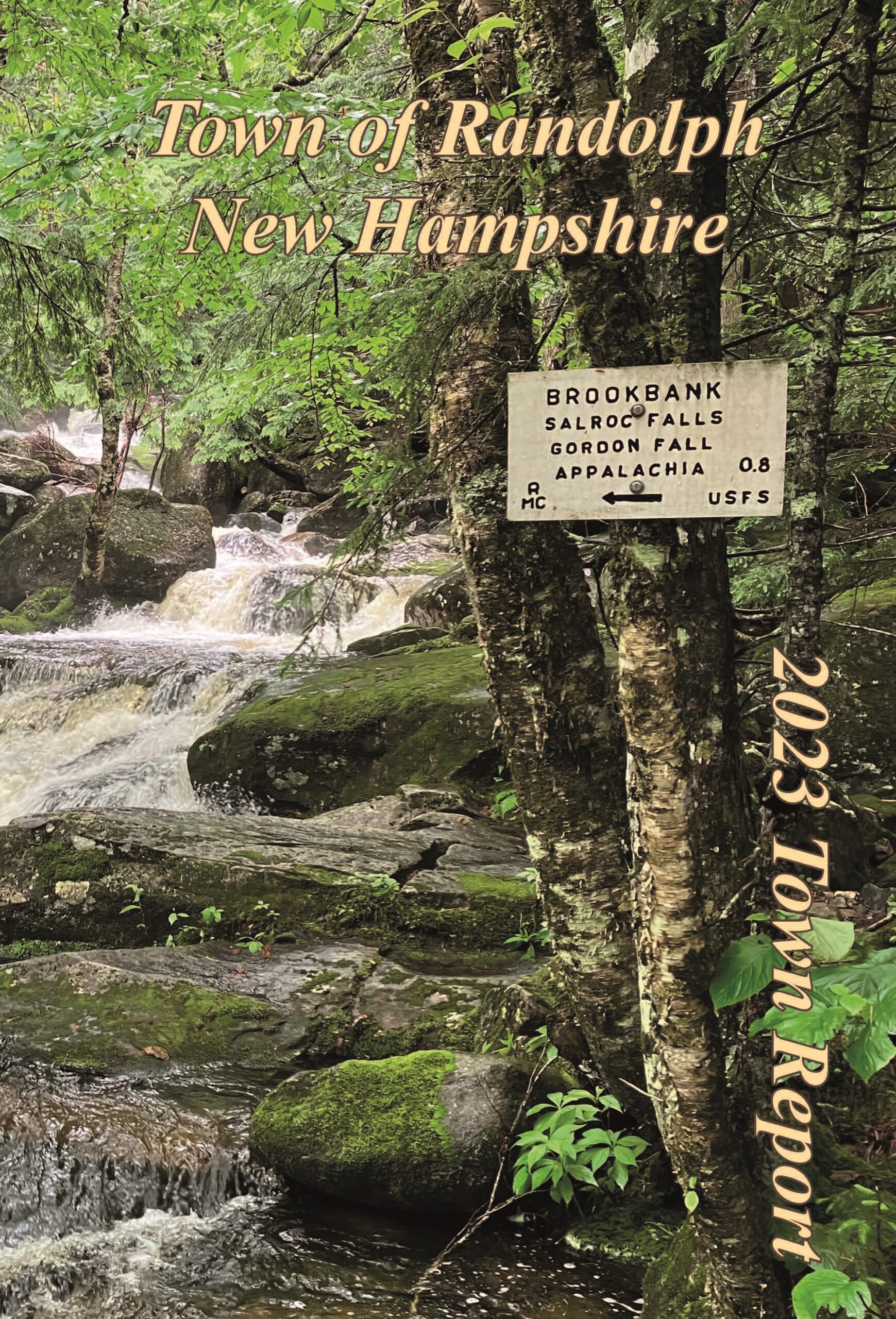

Randolph, NH is a heavily forested town in Coos County, NH., extending from the northern slopes of the White Mountains of the Presidential Range (to the south) to the Crescent Range and Berlin (to the north), with U.S. Route 2 cutting through the middle. The northern and southern parts of Randolph are within the White Mountain National Forest and the Ice Gulch Town Forest, while the central part is the settled portion of town.